Mid-Market majority

buyouts

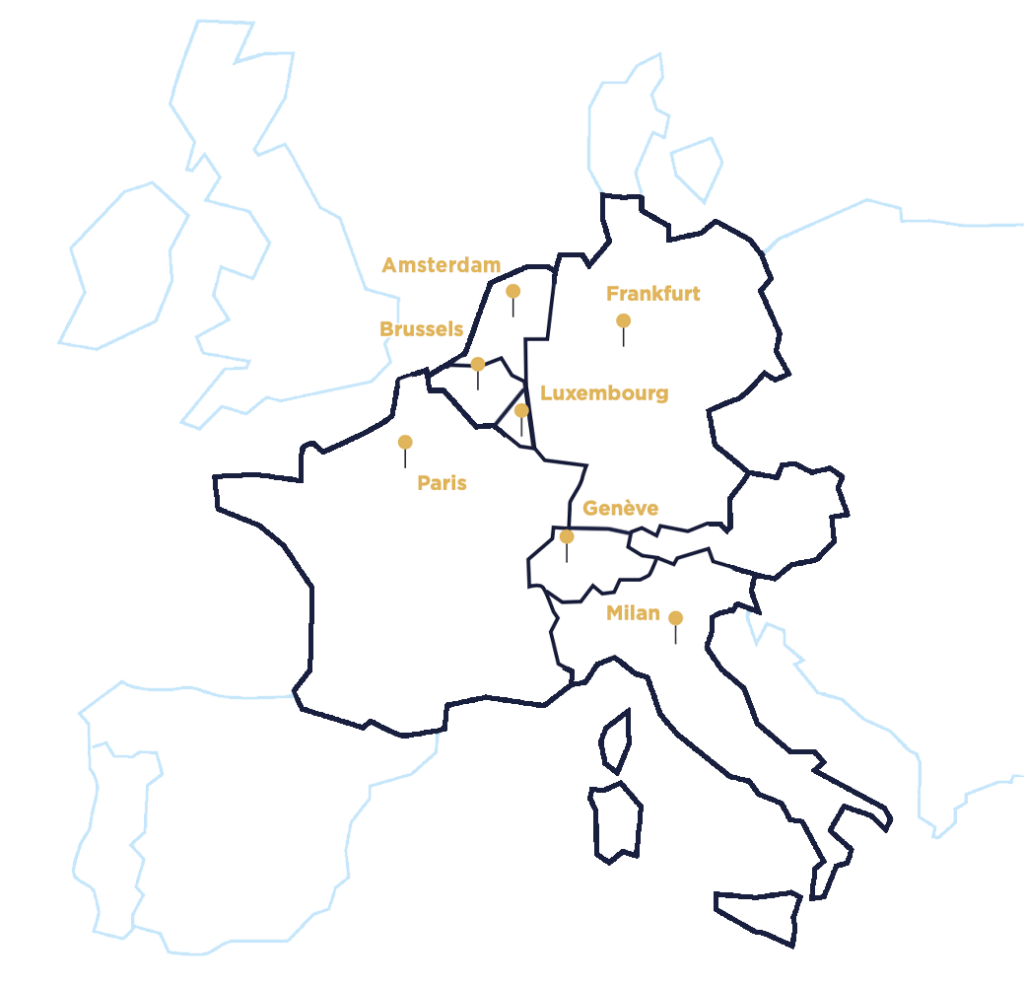

7 OFFICES

35+ Years of experience

€1.8 billion AUM

2 investment strategies

70 people

100+ companies supported

Building Stronger and more Sustainable Businesses

We unlock the full potential of the companies we invest in by bringing much more than capital – we unleash their development. We deliver sustainable and outstanding value for our investors thanks to our people-oriented and active-ownership approach.

Independent European Investment Platform

Our skilled European team invests in mid-sized companies with strong fundamentals and uses our unique value-creation methodology to help these companies accelerate their growth and ESG performance.

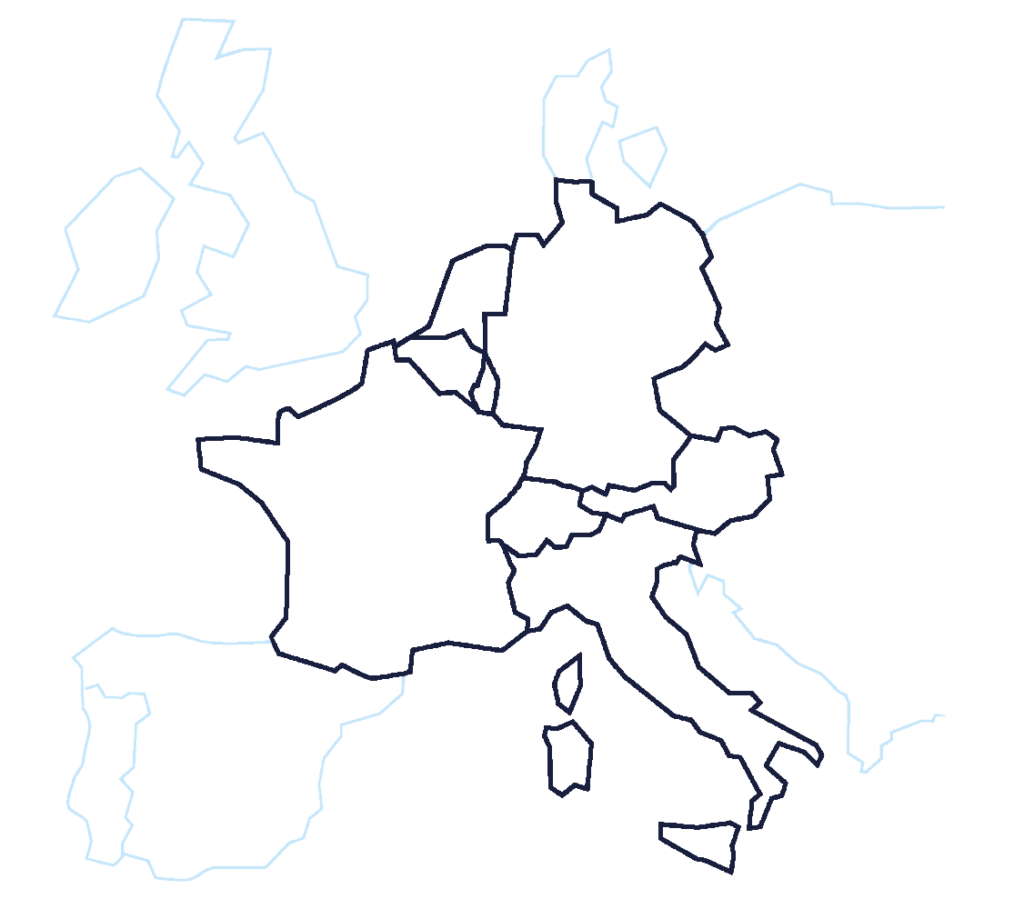

Seven offices, One team, Two investment strategies

Our strong pan-European presence is an essential part of our identity. We have operated on a European level right from the start since 1989, and Argos Wityu has now grown to 7 offices, enabling our team to build local networks for the long term.

Our CEOs

Lamberto Cuppini

CEOs of Fulgard — Italy

Bas Ambachtsheer

CEO of IJssel

— The Netherlands

Umberto Ferretti

CEO of BRACCHI — Italy

ESG is at the core of our DNA

One of the first 15 asset managers worldwide to commit to the Science-based targets initiative (SBTi).

Signatory of the PRI (Principles of Responsible Investment)

We help companies accelerate their growth by using a rigorous ESG approach.

Experienced Team

16 nationalities and languages spoken I 70 team members

Our team is key. Multicultural and multinational, this diversity brings together perspectives, knowledge and valuable skills. Our team is united by shared human values, which are intrinsically linked to each individual’s personality.

Thomas Ribéreau

Partner — France

Amélie Goureaux, Capucine Richemond, Caroline Fady & Pauline Humbert

Analyst — France

Nicola Honorati

Investment Manager — Italy

Argos Index® mid-market

Since 2004, this Index has tracked valuations of unlisted Eurozone mid-sized companies.

The Argos - BCG

Climate Transition Barometer

The European Mid-Market Decarbonisation Reference

Subscribe to our contents

News

Argos Wityu acquires Monviso, an Italian premium dry bakery manufacturer, from Cerea Partners and CAPZA.

Argos Wityu, an independent pan-European investment group, has acquired Monviso, an Italian premium dry bakery manufacturer, from Cerea Partners, an independent private equity firm, and CAPZA, a leading player in private investments in European SMEs. This acquisition marks the ninth investment by Argos Wityu’s Mid-Market VIII fund.

With approximately 90 years of expertise in the dry bakery industry, Monviso is a manufacturer of premium, gourmet, and healthy dry bakery products (including rusks, biscuits, and bread substitutes) based in Northern Italy.

Mid-market Argos Index® for the third quarter of 2024

The mid-market Argos Index® for the third quarter of 2024, published by Argos Wityu, the independent European investment fund, and Epsilon Research, the online platform for the management of unlisted M&A transactions, is now available. Launched in 2006, this index tracks the valuations of unlisted eurozone SMEs in which a majority stake has been acquired during the last six months.

“In the third quarter of 2024, acquisition prices for unlisted eurozone SMEs rose to 9.5x EBITDA. The index was boosted by a progressive recovery in M&A activity and a rebound in LBO transactions in the mid-market (between €15 million and €500 million). Higher prices were driven by the availability of capital and improved funding conditions, against the backdrop of a rapid fall in inflation that prompted the ECB to start a rate-cutting cycle. However, the process is a gradual one because of the major geopolitical uncertainties that remain in place, along with the eurozone’s weak economic growth,” said Louis Godron, Chair of Argos Wityu.

Argos Wityu acquires Lavatio GmbH, a leading German B2B textile rental and laundry service provider

The European independent private equity firm Argos Wityu, through its Argos Climate Action fund (Article 9 SFDR), has signed an agreement to acquire a majority stake in Lavatio GmbH from funds advised by Ufenau Capital Partners. The transaction is expected to close by the end of the year.

Lavatio, headquartered in Hünfeld, Germany, provides textile rental and laundry services to more than 2,200 active customers in the hotel, restaurant and catering as well as healthcare and workwear segments in Germany and Switzerland.